15.01.2018

Scaling up: George, Erste Group’s PSD2-ready banking platform, expands, approaching 2 million users

- Officially launches in Slovakia today; next up: the Czech Republic and Romania

- Plan to expand to all 16 million Erste customers in the group’s seven markets by end of 2018

- PSD2 to play to George’s strength as a continuously evolving open banking platform

George, the digital banking platform developed by Erste Group Bank AG’s in-house fintech, has officially been launched in Slovakia today, building on its success in Austria and growing popularity in the Czech Republic. George is already meeting the daily banking needs of approximately 2 million users across these markets: in Austria, George has already become the country’s most modern and popular banking platform, with nearly 1.5 million users (or more than every third online banking user in Austria) relying on it, while over 300,000 Czechs are handling their finances via George during its soft launch phase in the country. Erste Group aims to introduce its unified digital banking platform in all of its seven markets (Austria, Czech Republic, Slovakia, Romania, Hungary, Croatia and Serbia), thus making George the first pan-European banking platform that offers a full range of products and services across all platforms.

“Our vision for George was clear from the very beginning: we didn’t want to create yet another internet banking, we didn’t want to simply retrofit old systems. George is an entirely new way of banking, one reimagined for our digital age. We built it as a platform from the ground-up and co-designed it with our customers – and this is what makes George a game-changer that millions of people want to use. We’re excited about bringing it to Slovakia, and very soon to all of our other countries and beyond,” says Peter Bosek, Chief Retail Officer of Erste Group.

“Our customers have high expectations: banking with us should be as easy and intuitive as placing an order on Amazon or checking a social media account, but with advanced security and comprehensive protection for customers’ personal data. This is exactly what we’re going for with George: think of it as banking going social, while taking data security and privacy very seriously,” Bosek adds.

The future of banking is personal

“Our vision for George was clear from the very beginning: we didn’t want to create yet another internet banking, we didn’t want to simply retrofit old systems. George is an entirely new way of banking, one reimagined for our digital age. We built it as a platform from the ground-up and co-designed it with our customers – and this is what makes George a game-changer that millions of people want to use. We’re excited about bringing it to Slovakia, and very soon to all of our other countries and beyond,” says Peter Bosek, Chief Retail Officer of Erste Group.

“Our customers have high expectations: banking with us should be as easy and intuitive as placing an order on Amazon or checking a social media account, but with advanced security and comprehensive protection for customers’ personal data. This is exactly what we’re going for with George: think of it as banking going social, while taking data security and privacy very seriously,” Bosek adds.

The future of banking is personal

Because it has been designed with customer insights at its heart, George offers an exceptional degree of personalisation: everybody can create their very own version of George, tailored to their specific banking needs. That personalisation applies to how customers can view, sort and organize the comprehensive information that George provides them about their spending, savings, investments and payment transfers. Customers can, for example, choose to rename banking products and accounts, drag and drop account components together to create new groups that reflect their own approach to handling finances, and toggle between seeing items in either a list or “card” view, depending on their preference. George users being able to personalise their own background graphics is not just about convenience and fun, but also a real security benefit in that it also helps to thwart phishing attempts.

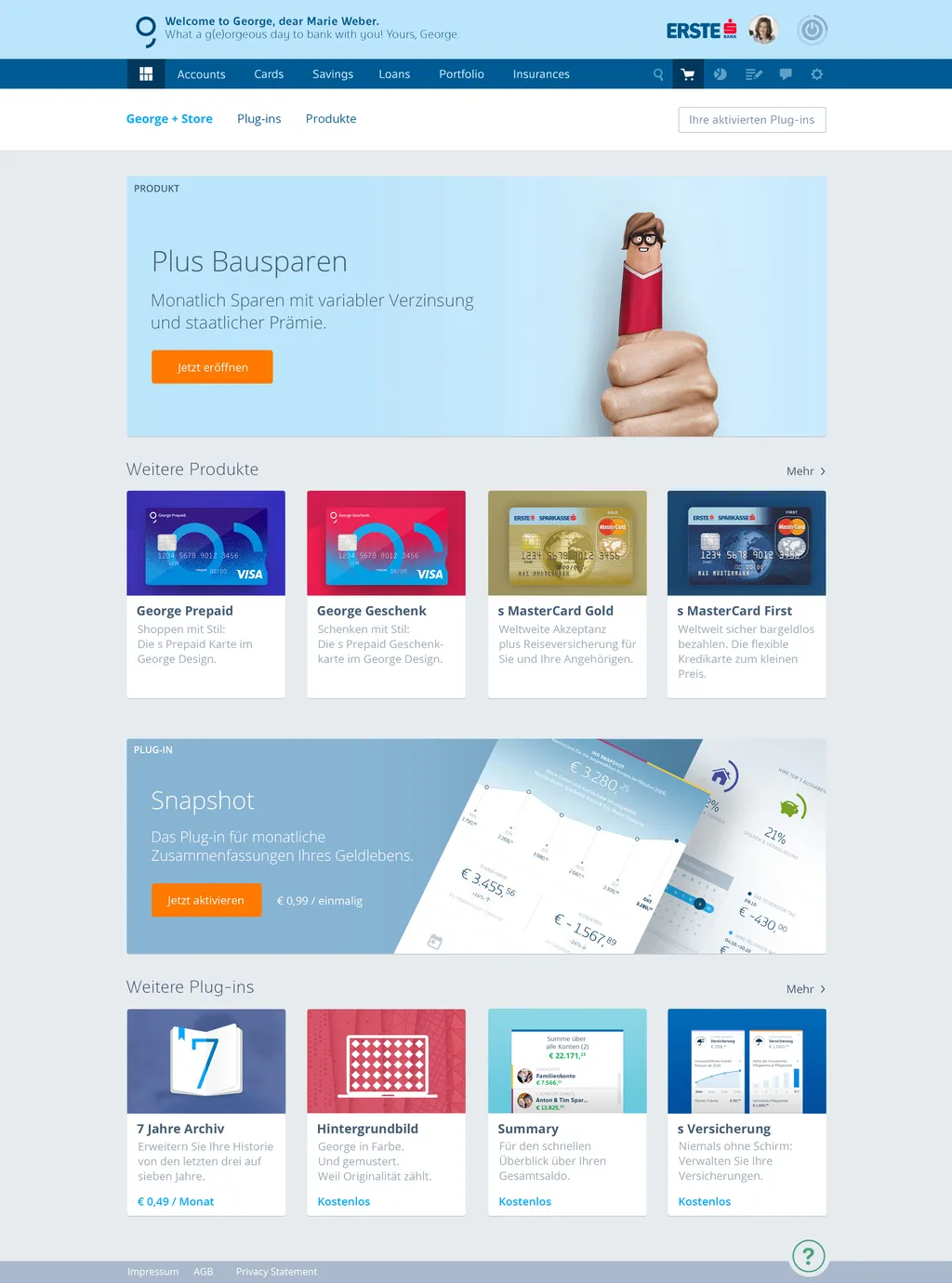

The ability to personalise George extends far beyond its look and feel: George lets its users choose from a broad range of plug-ins that offer additional functions which help to make banking easier, more effective and relevant for them. These include a seven-year account archive, a Remember2Pay function for upcoming bills, and “Watchdogs” that alert users when events that they have specified (like a certain payment transfer or share price development) take place. Some plug-ins are free, others are offered for purchase on a stand-alone basis or as part of monthly subscription packages – it’s up to George users to choose which selection works best for them.

George isn’t just pretty, it’s also smart: advances in technology also allow George to understand customers better than ever and tailor its offerings to them. For example, George’s Google-like elasticsearch makes it easier than ever for users to find the specific transactions they’re looking for: they simply type in a product name, a shop or an amount range and George provides them with a clear overview of the relevant results. Another example of George’s intelligent approach to handling data: George is able to learn IBANs, meaning that customers no longer have to type in long rows of account numbers -- just the first few letters in the name of the recipient will do and George will find the details in the address book, which it also updates automatically.

“One of the great benefits of digitalisation is that we can now offer to a broad base of millions of people solutions that are uniquely tailored to their very individual needs. That wasn’t possible before. With George, we’ve made a strong point of personalisation, so that our customers can choose how they interact with George, what George should look like, and the kind of help they expect from it. Relevance is the only way to make sure people will come back to George again and again—and in our experience in three markets so far, they most definitely are. For example, our Czech customers are, on average, using the mobile banking app George Go six times more frequently than our previous mobile offering in the local market,” Peter Bosek points out.

The future of banking is open

George’s open platform, API-based architecture and plug-in infrastructure make it exceptionally customisable and flexible, particularly for cooperation with fintechs and other third-party providers in the financial services sphere. The modularization which this API approach offers ensures better quality, higher levels of security, more flexibility and ensures that George can function optimally on top of local legacy systems.

That approach also ensures that George will continue to grow, not just geographically, but also by making the most of a platform that allows it to continually offer new features and services to its users. Those offerings can come not only from Erste Group itself, but also from third-parties such as fintechs. The one thing these offerings have in common: they provide customers with added value in the form of insights, abilities and ease, whether in conducting a transaction or considering future scenarios for their personal finances.

With over 210,000 plug-ins activated by users, George has already developed into a marketplace. “We’re convinced the future of banking will be built around platforms - and PSD2 will accelerate this. Since the very beginning, we’ve approached George with an open innovation mindset that allows us to form new partnerships with third parties and add value to our customers. So the current ‘platformification’ trend is totally playing to our strengths: our ambition is to build the iTunes store of European finance,” Bosek concludes.

Because it has been designed with customer insights at its heart, George offers an exceptional degree of personalisation: everybody can create their very own version of George, tailored to their specific banking needs. That personalisation applies to how customers can view, sort and organize the comprehensive information that George provides them about their spending, savings, investments and payment transfers. Customers can, for example, choose to rename banking products and accounts, drag and drop account components together to create new groups that reflect their own approach to handling finances, and toggle between seeing items in either a list or “card” view, depending on their preference. George users being able to personalise their own background graphics is not just about convenience and fun, but also a real security benefit in that it also helps to thwart phishing attempts.

The ability to personalise George extends far beyond its look and feel: George lets its users choose from a broad range of plug-ins that offer additional functions which help to make banking easier, more effective and relevant for them. These include a seven-year account archive, a Remember2Pay function for upcoming bills, and “Watchdogs” that alert users when events that they have specified (like a certain payment transfer or share price development) take place. Some plug-ins are free, others are offered for purchase on a stand-alone basis or as part of monthly subscription packages – it’s up to George users to choose which selection works best for them.

George isn’t just pretty, it’s also smart: advances in technology also allow George to understand customers better than ever and tailor its offerings to them. For example, George’s Google-like elasticsearch makes it easier than ever for users to find the specific transactions they’re looking for: they simply type in a product name, a shop or an amount range and George provides them with a clear overview of the relevant results. Another example of George’s intelligent approach to handling data: George is able to learn IBANs, meaning that customers no longer have to type in long rows of account numbers -- just the first few letters in the name of the recipient will do and George will find the details in the address book, which it also updates automatically.

“One of the great benefits of digitalisation is that we can now offer to a broad base of millions of people solutions that are uniquely tailored to their very individual needs. That wasn’t possible before. With George, we’ve made a strong point of personalisation, so that our customers can choose how they interact with George, what George should look like, and the kind of help they expect from it. Relevance is the only way to make sure people will come back to George again and again—and in our experience in three markets so far, they most definitely are. For example, our Czech customers are, on average, using the mobile banking app George Go six times more frequently than our previous mobile offering in the local market,” Peter Bosek points out.

The future of banking is open

George’s open platform, API-based architecture and plug-in infrastructure make it exceptionally customisable and flexible, particularly for cooperation with fintechs and other third-party providers in the financial services sphere. The modularization which this API approach offers ensures better quality, higher levels of security, more flexibility and ensures that George can function optimally on top of local legacy systems.

That approach also ensures that George will continue to grow, not just geographically, but also by making the most of a platform that allows it to continually offer new features and services to its users. Those offerings can come not only from Erste Group itself, but also from third-parties such as fintechs. The one thing these offerings have in common: they provide customers with added value in the form of insights, abilities and ease, whether in conducting a transaction or considering future scenarios for their personal finances.

With over 210,000 plug-ins activated by users, George has already developed into a marketplace. “We’re convinced the future of banking will be built around platforms - and PSD2 will accelerate this. Since the very beginning, we’ve approached George with an open innovation mindset that allows us to form new partnerships with third parties and add value to our customers. So the current ‘platformification’ trend is totally playing to our strengths: our ambition is to build the iTunes store of European finance,” Bosek concludes.