Business Review 2020

Key financial and operating data

2016 | 2017 | 2018 | 2019 | 2020 | |

Net interest income | 4,374.5 | 4,353.2 | 4,582.0 | 4,746.8 | 4,774.8 |

Net fee and commission income | 1,783.0 | 1,851.6 | 1,908.4 | 2,000.1 | 1,976.8 |

Net trading result and gains/losses from financial instruments at FVPL | 272.3 | 210.5 | 193.7 | 293.8 | 199.5 |

Operating income | 6,691.2 | 6,669.0 | 6,915.6 | 7,255.9 | 7,155.1 |

Operating expenses | -4,028.2 | -4,158.2 | -4,181.1 | -4,283.3 | -4,220.5 |

Operating result | 2,663.0 | 2,510.8 | 2,734.6 | 2,972.7 | 2,934.6 |

Impairment result from financial instruments | -195.7 | -132.0 | 59.3 | -39.2 | -1,294.8 |

Other operating result | -665.0 | -457.4 | -304.5 | -628.2 | -278.3 |

Pre-tax result from continuing operations | 1,950.4 | 2,077.8 | 2,495.0 | 2,329.7 | 1,368.0 |

Net result attributable to owners of the parent | 1,264.7 | 1,316.2 | 1,793.4 | 1,470.1 | 783.1 |

|

|

|

|

|

|

Net interest margin (on average interest-bearing assets) | 2.51% | 2.40% | 2.30% | 2.18% | 2.08% |

Cost/income ratio | 60.2% | 62.4% | 60.5% | 59.0% | 59.0% |

Provisioning ratio (on average gross customer loans) | 0.15% | 0.09% | -0.03% | 0.02% | 0.78% |

Tax rate | 21.2% | 19.7% | 13.3% | 18.0% | 25.0% |

Return on tangible equity | 12.3% | 11.5% | 15.2% | 11.2% | 5.1% |

Earnings per share (in EUR) | 2.93 | 2.94 | 4.02 | 3.23 | 1.57 |

|

|

|

|

|

|

Balance sheet (in EUR million) | Dec 16 | Dec 17 | Dec 18 | Dec 19 | Dec 20 |

Cash and cash balances | 18,353 | 21,796 | 17,549 | 10,693 | 35,839 |

Trading, financial assets | 48,320 | 42,752 | 43,930 | 44,295 | 46,849 |

Loans and advances to banks | 3,469 | 9,126 | 19,103 | 23,055 | 21,466 |

Loans and advances to customers | 130,654 | 139,532 | 149,321 | 160,270 | 166,050 |

Intangible assets | 1,390 | 1,524 | 1,507 | 1,368 | 1,359 |

Miscellaneous assets | 6,775 | 5,929 | 5,382 | 6,012 | 5,830 |

Total assets | 208,227 | 220,659 | 236,792 | 245,693 | 277,394 |

Financial liabilities held for trading | 4,762 | 3,423 | 2,508 | 2,421 | 2,625 |

Deposits from banks | 14,631 | 16,349 | 17,658 | 13,141 | 24,771 |

Deposits from customers | 138,013 | 150,969 | 162,638 | 173,846 | 191,070 |

Debt securities issued | 27,192 | 25,095 | 29,738 | 30,371 | 30,676 |

Miscellaneous liabilities | 7,027 | 6,535 | 5,381 | 5,437 | 5,840 |

Total equity | 16,602 | 18,288 | 18,869 | 20,477 | 22,410 |

Total liabilities and equity | 208,227 | 220,659 | 236,792 | 245,693 | 277,394 |

|

|

|

|

|

|

Loan/deposit ratio | 94.7% | 92.4% | 91.8% | 92.2% | 86.9% |

NPL ratio | 4.9% | 4.0% | 3.2% | 2.5% | 2.7% |

NPL coverage ratio (based on AC loans, ex collateral) | 69.1% | 68.8% | 73.4% | 77.1% | 88.6% |

Texas ratio | 34.6% | 29.2% | 24.5% | 19.9% | 20.3% |

Total own funds (CRR final, in EUR million) | 18,893 | 20,337 | 20,891 | 21,961 | 23,643 |

CET1 capital ratio (CRR final) | 12.8% | 12.9% | 13.5% | 13.7% | 14.2% |

Total capital ratio (CRR final) | 18.2% | 18.2% | 18.1% | 18.5% | 19.7% |

|

|

|

|

|

|

About the share | 2016 | 2017 | 2018 | 2019 | 2020 |

Shares outstanding at the end of the period | 429,800,000 | 429,800,000 | 429,800,000 | 429,800,000 | 429,800,000 |

Weighted average number of outstanding shares | 426,668,132 | 426,679,572 | 426,696,221 | 426,565,097 | 426,324,725 |

Market capitalisation (in EUR billion) | 12.0 | 15.5 | 12.5 | 14.4 | 10.7 |

High (in EUR) | 29.59 | 37.99 | 42.38 | 37.07 | 35.6 |

Low (in EUR) | 18.87 | 27.46 | 28.10 | 28.23 | 15.34 |

Closing price (in EUR) | 27.82 | 36.105 | 29.05 | 33.56 | 24.94 |

Price/earnings ratio | 9.5 | 11.8 | 7.0 | 9.8 | 13.7 |

Dividend per share (in EUR) | 1.00 | 1.20 | 1.40 | 0.00 | 0.50 |

Payout ratio | 34.0% | 39.2% | 33.6% | 0.0% | 27.4% |

Dividend yield | 3.6% | 3.3% | 4.8% | 0.0% | 2.0% |

Book value per share | 27.8 | 30.0 | 31.1 | 32.9 | 34.0 |

Price/book ratio | 1.0 | 1.2 | 0.9 | 1.0 | 0.7 |

|

|

|

|

|

|

Additional information | Dec 16 | Dec 17 | Dec 18 | Dec 19 | Dec 20 |

Employees (full-time equivalents) | 47,034 | 47,702 | 47,397 | 47,284 | 45,690 |

Branches | 2,648 | 2,565 | 2,507 | 2,373 | 2,193 |

Customers (in million) | 15.9 | 16.1 | 16.2 | 16.6 | 16.1 |

Data as of 26 February 2021

CRR: Capital Requirements Regulation

Shares outstanding include Erste Group shares held by savings banks that are members of the Haftungsverbund (cross-guarantee system).

Dividend 2020: The management board proposes to the annual general meeting in May – in line with ECB recommendation – a dividend for 2020 of EUR 0.5 per share. An additional EUR 1 per share has been reserved for a potential later payment.

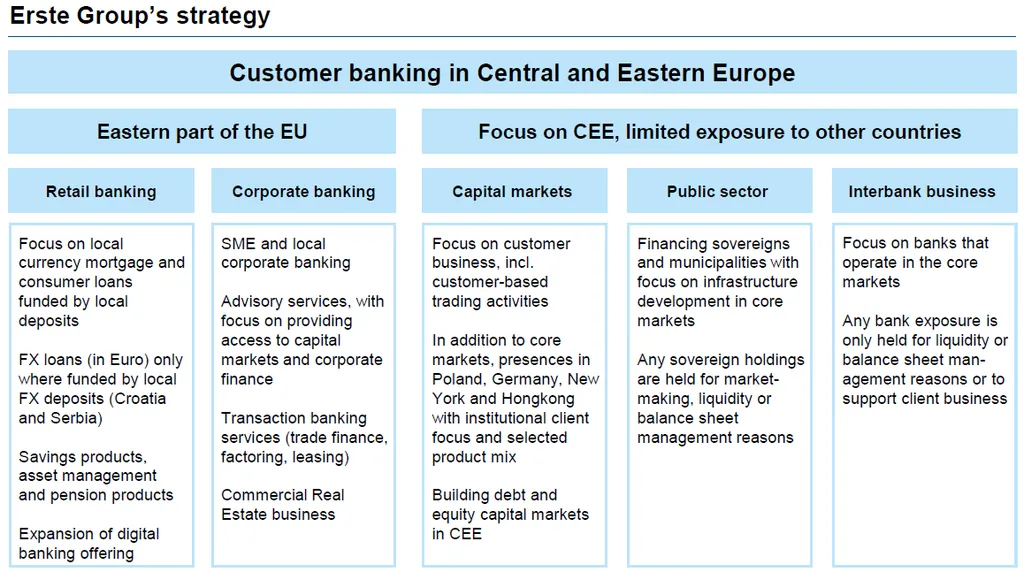

Strategy

Erste Group strives to be the leading retail and corporate bank in the eastern part of the European Union, including Austria. To achieve this goal, Erste Group aims to support its retail, corporate and public sector customers in realising their ambitions and ensuring financial health by offering excellent financial advice and solutions, lending responsibly and providing a safe harbour for deposits. Erste Group’s business activities will continue to contribute to economic growth and financial stability and thus to prosperity in its region. Erste Group’s strategy is based on three pillars:

_ Efficiency

_ Digital transformation

_ Growth

In all of its core markets in the eastern part of the European Union, Erste Group pursues a balanced business model focused on providing the best banking services to each of its customers. In this respect, digital innovations are playing an increasingly important role. Sustainability of the business model is reflected in the bank’s ability to fund customer loans by customer deposits, with most customer deposits being stable retail deposits. Sustainability of the bank’s strategy is reflected in long-term client trust, which underpins strong market shares in almost all of Erste Group’s core markets. However, market leadership is not an end in itself. Market leadership creates value only when it goes hand in hand with positive economies of scale and contributes to the long-term success of the company.

Financial and operating performance

P&L 2020 compared with 2019; balance sheet as of 31 December 2020 compared with 31 December 2019

Net interest income increased – mainly in Austria, but also in Romania and Hungary – to EUR 4,774.8 million (+0.6%; EUR 4,746.8 million). Net fee and commission income decreased to EUR 1,976.8 million (-1.2%; EUR 2,000.1 million). Higher income from the securities business and asset management did not fully compensate for the declines in other fee and commission income categories – most notably in payment services (thereof EUR 19 million attributable to the impact of the SEPA Payment Services Directive). While net trading result declined significantly to EUR 137.6 million (EUR 318.3 million), the line item gains/losses from financial instruments measured at fair value through profit or loss improved to EUR 62.0 million (EUR -24.5 million). The development of both line items was driven by valuation effects due to market volatility amid the Covid-19 pandemic. Operating income decreased to EUR 7,155.1 million (-1.4%; EUR 7,255.9 million). General administrative expenses declined to EUR 4,220.5 million (-1.5%; EUR 4,283.3 million), personnel expenses were slightly lower at EUR 2,520.7 million (-0.6%; EUR 2,537.1 million). Other administrative expenses were reduced to EUR 1,158.9 million (-3.8%; EUR 1,205.1 million). Payments into deposit insurance schemes included in other administrative expenses rose to EUR 132.2 million (EUR 104.8 million). Depreciation and amortisation was unchanged at EUR 540.9 million (EUR 541.0 million). Overall, the operating result declined to EUR 2,934.6 million (-1.3%; EUR 2,972.7 million). The cost/income ratio was unchanged at 59.0% (59.0%).

Due to net allocations, the impairment result from financial instruments amounted to EUR -1,294.8 million or 78 basis points of average gross customers loans (EUR -39.2 million or 7 basis points). Allocations to provisions for loans as well as for commitments and guarantees given went up in all core markets. The marked rise in allocations to provisions for loans was primarily driven by the deterioration in the macroeconomic outlook due to Covid-19. A positive contribution came from high income from the recovery of loans already written off, primarily in Romania and Hungary. The NPL ratio based on gross customer loans deteriorated to 2.7% (2.5%), the NPL coverage ratio rose to 88.6% (77.1%).

Other operating result improved to EUR -278.3 million (EUR -628.2 million). The expenses for the annual contributions to resolution funds included in this line item rose – in particular in Austria – to EUR 93.5 million (EUR 75.3 million). The decline in banking and transaction taxes to EUR 117.7 million (EUR 128.0 million) is primarily attributable to the abolition of banking tax in Romania. In the previous year, other operating result included allocations to a provision in the amount of EUR 153.3 million set aside for losses expected from a supreme court decision concerning the business activities of a Romanian subsidiary as well as the write-off of goodwill in Slovakia in the amount of EUR 165.0 million.

Taxes on income declined to EUR 342.5 million (EUR 418.7 million). The minority charge fell to EUR 242.3 million (EUR 440.9 million) due to significantly lower earnings contribution of the savings banks. The net result attributable to owners of the parent declined to EUR 783.1 million (-46.7%; EUR 1,470.1 million).

Total equity not including AT1 instruments rose to EUR 19.7 billion (EUR 19.0 billion). After regulatory deductions and filtering in accordance with CRR, common equity tier 1 capital (CET1, final) increased to EUR 17.1 billion (+4.9%; EUR 16.3 billion), total own funds (CRR final) to EUR 23.6 billion (EUR 22.0 billion). Total risk (risk-weighted assets) including credit, market and operational risk, CRR final) rose to EUR 120.2 billion (+1,3%; EUR 118.6 billion). The common equity tier 1 ratio (CET 1, CRR final) increased to 14.2% (13.7%), the total capital ratio to 19.7% (18.5%).

Total assets rose to EUR 277.4 billion (EUR 245.7 billion). On the asset side, cash and cash balances increased, primarily in Austria, to EUR 35.8 billion (EUR 10.7 billion), loans and advances to banks decreased to EUR 21.5 billion (EUR 23.1 billion). Loans and advances to customers increased to EUR 166.1 billion (+3.6%; EUR 160.3 billion). On the liability side, deposits from banks grew significantly to EUR 24.8 billion (EUR 13.1 billion) on the back of increased ECB refinancing (TLTROs). Customer deposits rose again – in all core markets, primarily in Austria and the Czech Republic – to EUR 191.1 billion (+9.9%; EUR 173.8 billion). The loan-to-deposit ratio stood at 86.9% (92.2%).

Segments

Erste Group’s segment reporting is based on IFRS 8 Operating Segments, which adopts the management approach. Accordingly, segment information is prepared on the basis of internal management reporting that is regularly reviewed by the chief operating decision maker to assess the performance of the segments and make decisions regarding the allocation of resources. Within Erste Group, the function of the chief operating decision maker is exercised by the management board.

Erste Group uses a matrix organisational structure with geographical segmentation and business segments. Since the chief operating decision maker performs the steering primarily based on geographical segments, those are defined as operating segments according to IFRS 8. In order to provide more comprehensive information, the performance of the business segments is reported additionally.

Non-financial report

2020 was not only characterised by the Covid-19 induced crisis but also by several initiatives to address environmental topics mostly to curb global warming. On 15 January 2020, the World Economic Forum listed in its Global Risk Report climate change and related environmental risks as the five most likely risks events. While infectious diseases did not make Top 10 in terms of likelihood they ranked tenth in terms of impact. At that time hardly anyone could have imagined how soon such a risk in the form of a new coronavirus would spread worldwide and that in order to protect healthcare systems significant social restrictions and economic lockdowns were to be implemented on a global scale. The Covid-19 induced crisis resulted in significant adverse economic impacts, but it also demonstrated how much can be achieved if policymakers focus on common goals.

For Erste Group, considering the impact of its entrepreneurial activities on society or the environment is nothing new. On the contrary, looking beyond financial performance is very much in line with the principles to which Erste österreichische Spar-Casse committed itself when it was founded more than 200 years ago. The Management Board adopted a Statement of Purpose to reaffirm and state in more detail the purpose of Erste Group to promote and secure prosperity across the region. It defines the following tasks and principles:

_ Disseminating and securing prosperity

_ Accessibility, independence and innovation

_ Profitability

_ Financial literacy

_ It is about people

_ Serving civil society

_ Transparency, stability, simplicity

Corporate Governance

Erste Group Bank AG is a stock corporation established according to Austrian law and since 2003 has declared its commitment to complying with the rules of the Austrian Code of Corporate Governance (Austrian CCG – see www.corporate-governance.at) with the objective of ensuring responsible and transparent corporate governance. In addition, the management board adopted a Statement of Purpose in 2015. This statement reaffirms and states in more detail the purpose of Erste Group Bank AG to promote and secure prosperity throughout the region in which Erste Group is active. Building on this Statement of Purpose, a Code of Conduct defines binding rules for day-to-day business. Erste Group values responsibility, respect and sustainability in pursuing its business activities. The Code of Conduct therefore helps to protect the reputation of Erste Group and to strengthen stakeholder confidence. The Corporate Governance Report has been prepared in accordance with sections 243c and 267b of the Austrian Commercial Code and Rules 60 et seq. of the Austrian CCG and combines the corporate governance report of Erste Group Bank AG, the parent, and the consolidated corporate governance report in one single report. The management board has also prepared a (consolidated) non-financial report in accordance with sections 243b and 267a of the Austrian Commercial Code, which is released as part of the annual report. As from the 2020 financial year, information on the total remuneration of individual members of the management board or the supervisory board and on the principles governing the remuneration policy is no longer required to be disclosed in this consolidated corporate governance report, but instead in a separate remuneration report pursuant to section 78e Austrian Stock Corporation Act.