19.04.2021

George Pro – internet banking with new functions for small businesses

George Pro – internet banking with new functions for small businesses

- Makes it easy to upload and manage invoices

- Provides liquidity preview for 12 months

- Data export simplifies collaboration with tax advisor

- Makes it easy to upload and manage invoices

- Provides liquidity preview for 12 months

- Data export simplifies collaboration with tax advisor

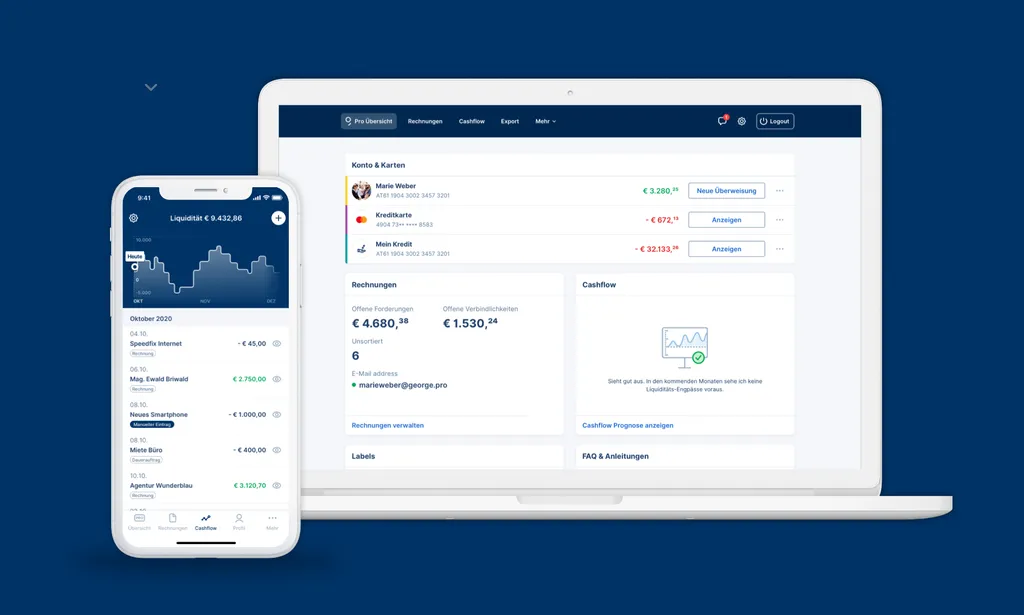

Erste’s banking platform George now has a Pro version that allows Erste Bank and Sparkasse customers to structure their current income and expenses or handle larger projects. In addition, the new plug-in makes it easy to manage invoices and makes it possible to forecast cash flow for the coming months. George Pro is geared primarily towards smaller enterprises, associations, freelancers, as well as to private customers handling larger projects, such as building a house.

“George Pro takes care of the many small-scale steps and provides its users with a better overview. By doing so, George Pro supports entrepreneurs in managing their finances. But also with larger private projects such as building or renovating a home, George easily structures running project costs,” says Thomas Schaufler, Erste Bank's management board member responsible for retail banking.

Invoice management and cash flow: easy handling for better planning

Erste’s banking platform George now has a Pro version that allows Erste Bank and Sparkasse customers to structure their current income and expenses or handle larger projects. In addition, the new plug-in makes it easy to manage invoices and makes it possible to forecast cash flow for the coming months. George Pro is geared primarily towards smaller enterprises, associations, freelancers, as well as to private customers handling larger projects, such as building a house.

“George Pro takes care of the many small-scale steps and provides its users with a better overview. By doing so, George Pro supports entrepreneurs in managing their finances. But also with larger private projects such as building or renovating a home, George easily structures running project costs,” says Thomas Schaufler, Erste Bank's management board member responsible for retail banking.

Invoice management and cash flow: easy handling for better planning

One central feature of George Pro: its clear and greatly simplified management of invoices. Users can either photograph and upload invoices using a mobile phone or email them to a specially set-up address, which then uploads invoice files into the system. Once uploaded, users then can classify and process invoices. George Pro automatically detects whether the respective invoice has already been paid and sends a push message if any outstanding invoice is overdue. For outstanding outgoing invoices, a payment reminder with an individual text template can be sent to customers and partners directly from the system.

A detailed liquidity forecast for the next 12 months provides users with additional planning capabilities: When users browse through upcoming receipts and payments, their available account balance adjusts to reflect a forecast value for the selected future date. To do so, George Pro evaluates upcoming income and expenses which are pre-noted in the accounts managed by George Pro. In addition, manual entries can be added and potential scenarios – such as a non-paying client – can be calculated. The cash flow outlook also offers account holders an alarm function which warns them of expected financial bottlenecks and visualises liquidity-critical periods accordingly in advance.

Data export and visualisation: simple collaboration with the tax advisor

In addition, George Pro offers a simple export of all data in .csv and .xlsx formats, so that customers can have a comprehensive list of their invoices and transactions containing all essential information needed by, for example, their tax advisors. Another thing that makes George George: visual elements that provide an additional overview of important account information. Users can use labels to categorise all income and expenses with colours and keywords, allowing them to keep a better track of income and expenses.

The George Pro plug-in is activated in the George Store on a desktop computer and can then also be used on a smartphone. George Pro runs parallel to the regular George view, allowing users to easily switch back and forth between the two interfaces. The George Pro plug-in is free for the first three months, subsequently costs EUR 6.99 per month, and can be cancelled at any time at the end of each month.

Overview of George Pro:

- Availability: from 12 April 2021 for all George users at Erste Bank and Sparkas

- Target group: Freelancers, small businesses, associations, doctors, as well as people with special projects (building a house, etc.)

- Costs: three months free of charge; subsequently 6.99 euros per month; cancellation at any time at the end of the month.

- Activation: directly in George (browser version); plug-in with separate view in all interfaces.

- Essential functions:

- Cash flow management

- Invoices: simple upload of different file formats, automated recognition and matching with outgoing and incoming payments, payment reminders for outgoing and incoming invoices

- Categorisation by labels and keywords

- Export function to common Excel formats