29.11.2018

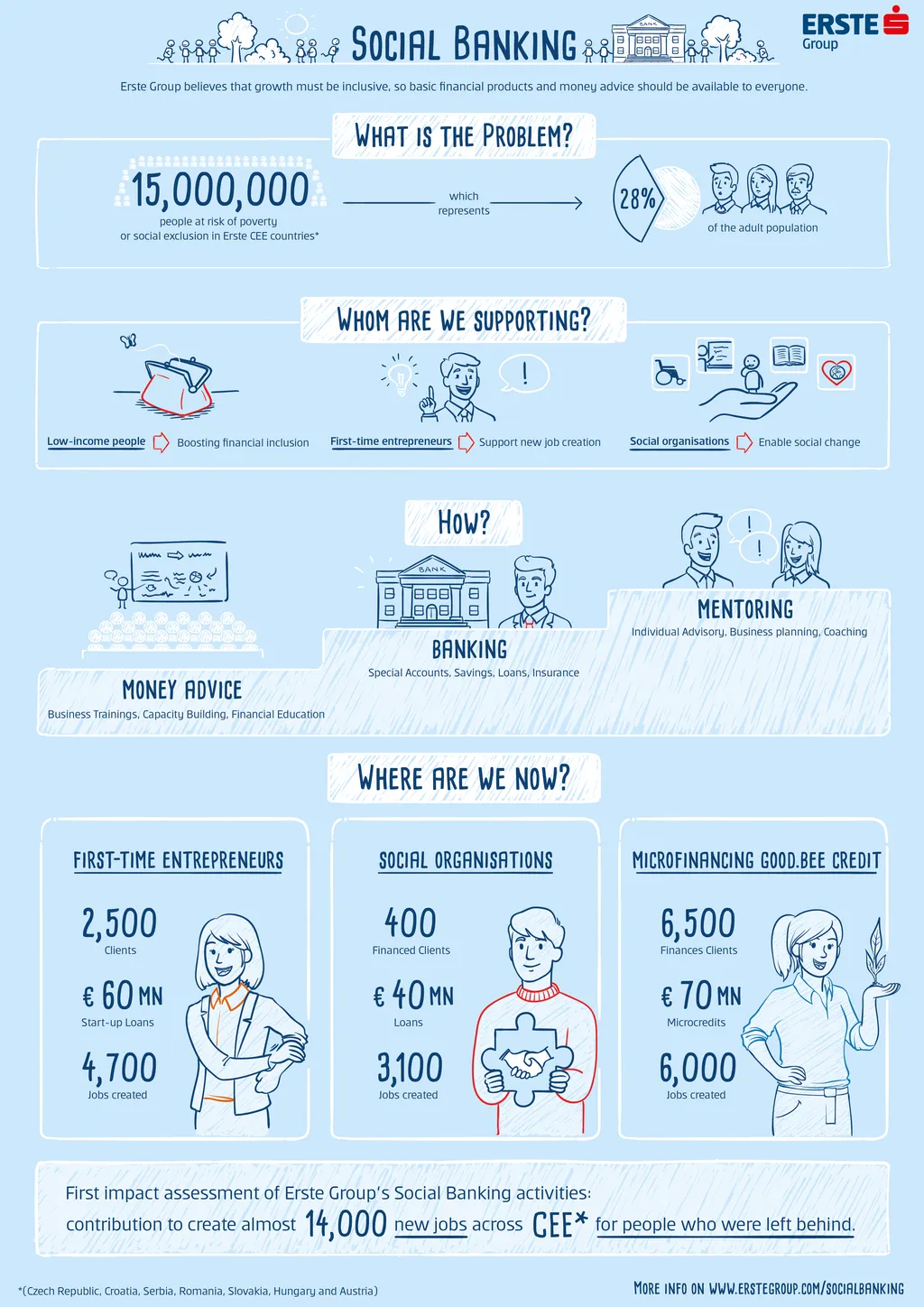

First impact assessment of Erste Group’s Social Banking activities: 14,000 new jobs created across CEE for people who were left behind

- More than 2,500 starting entrepreneurs received business advice and financing;

- 400 funded social enterprises and NGOs employed over 1,500 people from socially excluded groups;

- Almost 14,000 new jobs were created across CEE

- Total loan volume exceeded EUR 170 million

The first impact assessment of Erste Group’s social banking activities across all of its CEE markets published today shows that over 2,500 starting entrepreneurs, 400 social organisations and 6,500 small farmers accessed its offering and contributed to the creation of almost 14,000 new jobs. Inspired by Erste’s origins as a social banking enterprise and developed at present with the support of ERSTE Foundation, Erste Group’s Social Banking fosters job creation and prosperity by addressing the needs of socially excluded groups with not just loans, but also sound money advice, financial literacy trainings, tailored products and business mentoring.

“Social Banking, which is our flagship initiative for increasing social and financial inclusion across the CEE region, has been systematically rolled out to all of Erste Group’s core markets since 2016. We believe we can make a real difference for the people who were left behind during the transition to a market economy. Having access to business advice and start-up loans, over 2,500 people mostly living in rural areas and smaller cities managed to start their own business and employ other people from their local communities. More than a third of them had been economically inactive before. And the thing that we are most proud of is that these jobs were mostly created in areas with high unemployment and poverty, often ignored by large employers,” says Peter Surek, Head of Social Banking Development.

The first impact assessment of Erste Group’s social banking activities across all of its CEE markets published today shows that over 2,500 starting entrepreneurs, 400 social organisations and 6,500 small farmers accessed its offering and contributed to the creation of almost 14,000 new jobs. Inspired by Erste’s origins as a social banking enterprise and developed at present with the support of ERSTE Foundation, Erste Group’s Social Banking fosters job creation and prosperity by addressing the needs of socially excluded groups with not just loans, but also sound money advice, financial literacy trainings, tailored products and business mentoring.

“Social Banking, which is our flagship initiative for increasing social and financial inclusion across the CEE region, has been systematically rolled out to all of Erste Group’s core markets since 2016. We believe we can make a real difference for the people who were left behind during the transition to a market economy. Having access to business advice and start-up loans, over 2,500 people mostly living in rural areas and smaller cities managed to start their own business and employ other people from their local communities. More than a third of them had been economically inactive before. And the thing that we are most proud of is that these jobs were mostly created in areas with high unemployment and poverty, often ignored by large employers,” says Peter Surek, Head of Social Banking Development.

Erste Group was advised by the NPO Institute [1] of the Vienna University of Economics and Business on developing the impact assessment methodology. The Group intends to carry out regular impact assessments of the Social Banking programme.

The first report shows that Social Banking supported people who otherwise had no or very poor access to the labour market to start their own micro business, such as a shop or a construction firm. The new entrepreneurs also gained the much-needed financial confidence and created almost 5,000 jobs in their communities. Besides business mentoring and e-learning, Erste Group’s Social Banking provided more than EUR 60 million worth of financing to such early stage entrepreneurs.

Erste Group was advised by the NPO Institute [1] of the Vienna University of Economics and Business on developing the impact assessment methodology. The Group intends to carry out regular impact assessments of the Social Banking programme.

The first report shows that Social Banking supported people who otherwise had no or very poor access to the labour market to start their own micro business, such as a shop or a construction firm. The new entrepreneurs also gained the much-needed financial confidence and created almost 5,000 jobs in their communities. Besides business mentoring and e-learning, Erste Group’s Social Banking provided more than EUR 60 million worth of financing to such early stage entrepreneurs.

Working through its network of local banks and also in partnership with other organisations and NGOs, Erste Group’s Social banking also supported around 400 social organisations across the region, helping them to grow and deal more efficiently with some of the most challenging issues in our society, such as youth unemployment, social integration and poverty. As a result, more than 3,100 jobs were created and 6,100 jobs were preserved in the social sector. 82% of the organizations reported that they can better fulfil their social mission, reach more people and start new projects. The total financing amounted to EUR 40 million and consisted of working capital loans that were used to cope with late payments of subsidies or grants; bridge loans for pre-financing or co-financing for an EU/local government project; and investment loans to support expanding services and activities.

Furthermore, Erste Group’s microfinance entity good.bee Credit provided microcredits for 6,500 small entrepreneurs from rural and small urban areas in Romania. The subsidiary granted nearly 10,000 micro-loans mostly to farmers, amounting to more than EUR 70 million and resulting in 6,000 newly created jobs. 70% of the clients who registered managed to increase their household income and invest it back into business development but also in improving their living conditions.

“The lack of financial education is one of the biggest barriers to entrepreneurship in our region. That’s why education is as important as financing, and both are at the heart of our approach to social banking. We recognised early on that financing alone does not solve the problem. What’s needed is a long-term, systematic and joint commitment to invest time and resources into training these people, giving them the financial skills and confidence they need to improve their livelihood. The results announced today strengthen our determination to expand social banking. We’re also going to intensify our engagement with decision-makers and regulators to increase their awareness that more support is needed for the 15 million people in our region who are left behind,” stated Andreas Treichl CEO of Erste Group.

[1] The underlying impact value chain and its “theory of change” was co-developed by the “Competence Centre for Nonprofit Organisations and Social Entrepreneurship” (NPO&SE, www.npo.or.at) of the Vienna University of Economics and Business