Is Austria Ready for Banking with Facebook and Google? ...and then there was George

The digital revolution has changed many sectors lastingly. Now it is reaching banking as well.

As a result, Erste Bank und Sparkassen are pursuing a vision: to make life easier with intelligent and adaptable technologies.

The digital revolution has lastingly changed many sectors. Now it is reaching banking as well. New payment functions, money transfers over social networks or financial services in the form of apps not only change one's personal financial life, but also represent an enormous challenge to the classical retail bank. Banks must react, but how?

Changes that are brought about by altered customer behaviour and new technologies cannot simply be met by prettifying online banking platforms that are getting long in the tooth by now. Digitalization amounts to far more than merely up-to-date design. “Much will depend on whether we are now a creative trendsetter or an outdistanced victim of digitalization”, Peter Bosek, member of the management board is convinced.

For this reason, Erste Bank und Sparkassen are pursuing a vision: to make life easier with intelligent and adaptable technologies and to make financial services not only simpler, faster and less complicated, but to imbue them at the same time with a personality. Erste Bank und Sparkassen have found an answer to fast changing digital markets with an entirely new product – and have given it a name: George.

The digital revolution has changed many sectors lastingly. Now it is reaching banking as well.

As a result, Erste Bank und Sparkassen are pursuing a vision: to make life easier with intelligent and adaptable technologies.

The digital revolution has lastingly changed many sectors. Now it is reaching banking as well. New payment functions, money transfers over social networks or financial services in the form of apps not only change one's personal financial life, but also represent an enormous challenge to the classical retail bank. Banks must react, but how?

Changes that are brought about by altered customer behaviour and new technologies cannot simply be met by prettifying online banking platforms that are getting long in the tooth by now. Digitalization amounts to far more than merely up-to-date design. “Much will depend on whether we are now a creative trendsetter or an outdistanced victim of digitalization”, Peter Bosek, member of the management board is convinced.

For this reason, Erste Bank und Sparkassen are pursuing a vision: to make life easier with intelligent and adaptable technologies and to make financial services not only simpler, faster and less complicated, but to imbue them at the same time with a personality. Erste Bank und Sparkassen have found an answer to fast changing digital markets with an entirely new product – and have given it a name: George.

Austrians trust banks, but are missing good design and user-friendliness

In the course of the digital revolution, many competitors mainly from outside the industry are swamping the market for financial services. Apart from numerous fintech start-ups, which here and there already offer solutions in the form of apps or other small applications, there are the already established large internet corporations which want to exploit the pioneering spirit in the banking sector for their own purposes as well. Whether Google, Facebook, Apple or Amazon – they are all working on opportunities to position themselves in the digital life experience of their users with smart financial services

Would Austrians actually use such services though?

A representative survey by Integral on behalf of Erste Bank und Sparkassen has revealed the following; in a direct comparison of their own online banking platforms with one of the large internet groups (Facebook, Google and Amazon), the following evaluations were reported:

- 74% are certain that their own data are secure from access by third parties at their bank. Only 1% believe the same of Google.

- 81% call their bank trustworthy. 3% say the same of Facebook

- 75% know whom they can turn to in their bank if they have questions or problems. Only 5% know whom to turn to at Google or Facebook.

However, when it comes to having fun using a service, and in terms of design and personalization, current online banking services are lagging way behind:

- 45% have fun using Facebook. Only 18% can say the same of their online banking platform.

- 4 out of 10 consider Amazon's design to be top-notch. Only every fifth says that about online banking.

- 56% on the other hand are irritated by unwanted advertisements at Google. Only 6% consider this a problem with the online presence of their bank.

The willingness to use financial services at the internet giants remains so far slight. 8 out of 10 wouldn't buy a financial product at Amazon, 88% wouldn't do so at Google either and even 94% cannot imagine doing so at Facebook. Nevertheless: Due to the market power of the digital giants, the probability is very high that their services, once they are established on the internet and are slickly embedded in well-known platforms, will be intensively used. “However, as a bank for retail customers, we don't want to degenerate into a mere infrastructure and settlement provider, while large internet companies are developing smart platforms for users”, Bosek says. After all, the objective is “the maintenance of direct customer contact – and for this purpose a digital revolution is now needed, which we intend to lead.”

Austrians trust banks, but are missing good design and user-friendliness

In the course of the digital revolution, many competitors mainly from outside the industry are swamping the market for financial services. Apart from numerous fintech start-ups, which here and there already offer solutions in the form of apps or other small applications, there are the already established large internet corporations which want to exploit the pioneering spirit in the banking sector for their own purposes as well. Whether Google, Facebook, Apple or Amazon – they are all working on opportunities to position themselves in the digital life experience of their users with smart financial services

Would Austrians actually use such services though?

A representative survey by Integral on behalf of Erste Bank und Sparkassen has revealed the following; in a direct comparison of their own online banking platforms with one of the large internet groups (Facebook, Google and Amazon), the following evaluations were reported:

- 74% are certain that their own data are secure from access by third parties at their bank. Only 1% believe the same of Google.

- 81% call their bank trustworthy. 3% say the same of Facebook

- 75% know whom they can turn to in their bank if they have questions or problems. Only 5% know whom to turn to at Google or Facebook.

However, when it comes to having fun using a service, and in terms of design and personalization, current online banking services are lagging way behind:

- 45% have fun using Facebook. Only 18% can say the same of their online banking platform.

- 4 out of 10 consider Amazon's design to be top-notch. Only every fifth says that about online banking.

- 56% on the other hand are irritated by unwanted advertisements at Google. Only 6% consider this a problem with the online presence of their bank.

The willingness to use financial services at the internet giants remains so far slight. 8 out of 10 wouldn't buy a financial product at Amazon, 88% wouldn't do so at Google either and even 94% cannot imagine doing so at Facebook. Nevertheless: Due to the market power of the digital giants, the probability is very high that their services, once they are established on the internet and are slickly embedded in well-known platforms, will be intensively used. “However, as a bank for retail customers, we don't want to degenerate into a mere infrastructure and settlement provider, while large internet companies are developing smart platforms for users”, Bosek says. After all, the objective is “the maintenance of direct customer contact – and for this purpose a digital revolution is now needed, which we intend to lead.”

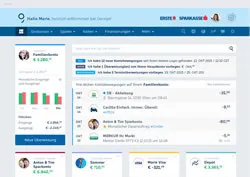

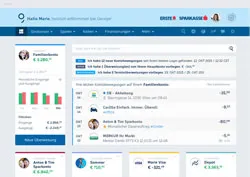

George was developed in order to set new standards in Austria's financial sector

George combines the positive aspects of both worlds: the security and trustworthiness of a bank with fun in usage as well as an attractive design. In addition, there is a plethora of individual personalization options and technological innovations, which not only make personal finances simpler, but also better.

George isn't just online banking with a polished up user interface. George is to be understood as a system that thinks for itself and continually grows, an intelligent and flexible banking personality, which adjusts to its customers with elements that can be individually combined. “George is absolutely unique in the Austrian market.

In terms of design and usability we no longer lag in any way behind the internet giants”, Boris Marte, head of Erste Hub, the innovations lab of Erste Bank, is convinced.

In terms of design and usability we no longer lag in any way behind the internet giants

George's main ability is to process and present data in a manner that allows one to see one's finances like never before. A clear structure, intuitive menus, focus on what is important, but at the same time individual design options, and not least a new, highly personal approach are the most important features.

A radically simplified search function, which is perhaps better regarded as a “find function”, can be taken for granted with George, just as the assignment of favourite colours, names and faces to accounts and products. With that, George puts an end to pure “numbered accounts”. George moreover makes money transfers intelligent and intuitive. Complicated forms are just as passé as the memorization of IBANs.

Plug-Ins

Entirely new with George: One can augment one's own digital banking via a special plug-in store in any way one wishes. For example, one's account data with other banks can be integrated in George, or searches of one's account history can be individually adjusted. These additional services are continually expanded, with augmentations partly free of charge, partly available for a fee, for one's very own George. During development and the continual monitoring of its growth process, customer wishes and experiences were integrated: “George looks the way it looks today because many customers and employees have provided us with excellent feedback during the beta testing period, which we have incorporated”, Boris Marte explains. This is new in the Austrian market as well: bank customers help with the design of products and actively contribute information about their experiences and habits.

Personal Support

The direct connection to ones personal bank advisor is also strengthened further with George.

Over a specially secured communication channel one can either contact one's bank advisor directly, or schedule a meeting on one's own.

Over a support chat function any short term questions can be dealt with in real time. With George, digital banking means not less, but more personal support.

The combination of facilitating user technology with an individual approach and consultation with real people, is just one decisive advantage of George. “No payment system on one's cell-phone, no matter how modern, can do this, and no quick start-up app can offer anything similar either. Only George is able to do that”, explains Marte:

Intuitive, fast, transparent

With George one's own financial affairs are supposed to be fun. The vision and philosophy is that the basic functions of online banking remain intact. In addition, there are numerous functions which make banking a transparent and intuitive experience. These are the most important features:

01 Overview

- Fast, sorted overview over account balances and transactions.

- Operating in a playful manner: diagrams and statistics visualize financial behaviour and compare monthly transaction volumes

- Personalization: colours and profile pictures help with classifying accounts.

02 Search

- Auto-fill function: one can “Google” for transactions, names and dates – George recognizes the target already after a few keystrokes

- Within search terms, results are displayed with logos

- Endless scrolling: The search function covers three years, up to seven years are possible with a plug-in

03 Plug-Ins

- Personalization: With additional functions, every customer can design his personal banking experience.

- A number of services are free of charge, some cost a small fee

- Import of account data from other banks (especially interesting when switching accounts, since one won't have to do without one's account history):

- The transaction archive can be expanded to seven years. An interesting feature especially for the growing group of freelance professionals

04 Money transfers

- Simple, tidy intuitive: enter names into the transfer mask and the form is automatically filled in with IBAN and other data

- George remembers every transaction. IBANs and account numbers become a side issue

- SEPA or foreign payment: George knows where the recipient is located and prepares the transfer accordingly

05 Help

- Via chat function direct contact with the support team, no waiting times

- Screenshot function: If there is a problem, one can save the image concerned, add comments to it and send it in anonymized form to an advisor.

- Secure information channel for sensitive financial data, no e-mails.

Why is George actually called George?

100 years ago, Lawrence Sperry revolutionized aviation. He invented the first autopilot, which was affectionately named George. “Let George do it!”, soon became almost literally winged words, which stood for confidence in technology. Confidence in inventions, which make life easier and safer.

We regard George the autopilot as a role model for George, the most modern banking application in Austria. An invention that takes routine tasks off one's hands, and makes financial transactions simpler and more intelligent.

About the Survey

On behalf of Erste Bank und Sparkassen, market research institution INTEGRAL has conducted an online survey which is representative for Austria's overall population above the age of 16. In the time period 21.-30. November 2014, 900 persons were interviewed about topics relating to online banking in comparison with established internet giants.

George was developed in order to set new standards in Austria's financial sector

George combines the positive aspects of both worlds: the security and trustworthiness of a bank with fun in usage as well as an attractive design. In addition, there is a plethora of individual personalization options and technological innovations, which not only make personal finances simpler, but also better.

George isn't just online banking with a polished up user interface. George is to be understood as a system that thinks for itself and continually grows, an intelligent and flexible banking personality, which adjusts to its customers with elements that can be individually combined. “George is absolutely unique in the Austrian market.

In terms of design and usability we no longer lag in any way behind the internet giants”, Boris Marte, head of Erste Hub, the innovations lab of Erste Bank, is convinced.

In terms of design and usability we no longer lag in any way behind the internet giants

George's main ability is to process and present data in a manner that allows one to see one's finances like never before. A clear structure, intuitive menus, focus on what is important, but at the same time individual design options, and not least a new, highly personal approach are the most important features.

A radically simplified search function, which is perhaps better regarded as a “find function”, can be taken for granted with George, just as the assignment of favourite colours, names and faces to accounts and products. With that, George puts an end to pure “numbered accounts”. George moreover makes money transfers intelligent and intuitive. Complicated forms are just as passé as the memorization of IBANs.

Plug-Ins

Entirely new with George: One can augment one's own digital banking via a special plug-in store in any way one wishes. For example, one's account data with other banks can be integrated in George, or searches of one's account history can be individually adjusted. These additional services are continually expanded, with augmentations partly free of charge, partly available for a fee, for one's very own George. During development and the continual monitoring of its growth process, customer wishes and experiences were integrated: “George looks the way it looks today because many customers and employees have provided us with excellent feedback during the beta testing period, which we have incorporated”, Boris Marte explains. This is new in the Austrian market as well: bank customers help with the design of products and actively contribute information about their experiences and habits.

Personal Support

The direct connection to ones personal bank advisor is also strengthened further with George.

Over a specially secured communication channel one can either contact one's bank advisor directly, or schedule a meeting on one's own.

Over a support chat function any short term questions can be dealt with in real time. With George, digital banking means not less, but more personal support.

The combination of facilitating user technology with an individual approach and consultation with real people, is just one decisive advantage of George. “No payment system on one's cell-phone, no matter how modern, can do this, and no quick start-up app can offer anything similar either. Only George is able to do that”, explains Marte:

Intuitive, fast, transparent

With George one's own financial affairs are supposed to be fun. The vision and philosophy is that the basic functions of online banking remain intact. In addition, there are numerous functions which make banking a transparent and intuitive experience. These are the most important features:

01 Overview

- Fast, sorted overview over account balances and transactions.

- Operating in a playful manner: diagrams and statistics visualize financial behaviour and compare monthly transaction volumes

- Personalization: colours and profile pictures help with classifying accounts.

02 Search

- Auto-fill function: one can “Google” for transactions, names and dates – George recognizes the target already after a few keystrokes

- Within search terms, results are displayed with logos

- Endless scrolling: The search function covers three years, up to seven years are possible with a plug-in

03 Plug-Ins

- Personalization: With additional functions, every customer can design his personal banking experience.

- A number of services are free of charge, some cost a small fee

- Import of account data from other banks (especially interesting when switching accounts, since one won't have to do without one's account history):

- The transaction archive can be expanded to seven years. An interesting feature especially for the growing group of freelance professionals

04 Money transfers

- Simple, tidy intuitive: enter names into the transfer mask and the form is automatically filled in with IBAN and other data

- George remembers every transaction. IBANs and account numbers become a side issue

- SEPA or foreign payment: George knows where the recipient is located and prepares the transfer accordingly

05 Help

- Via chat function direct contact with the support team, no waiting times

- Screenshot function: If there is a problem, one can save the image concerned, add comments to it and send it in anonymized form to an advisor.

- Secure information channel for sensitive financial data, no e-mails.

Why is George actually called George?

100 years ago, Lawrence Sperry revolutionized aviation. He invented the first autopilot, which was affectionately named George. “Let George do it!”, soon became almost literally winged words, which stood for confidence in technology. Confidence in inventions, which make life easier and safer.

We regard George the autopilot as a role model for George, the most modern banking application in Austria. An invention that takes routine tasks off one's hands, and makes financial transactions simpler and more intelligent.

About the Survey

On behalf of Erste Bank und Sparkassen, market research institution INTEGRAL has conducted an online survey which is representative for Austria's overall population above the age of 16. In the time period 21.-30. November 2014, 900 persons were interviewed about topics relating to online banking in comparison with established internet giants.